Unlocking Wealth: Lessons from Warren Buffett's Value Investing

Written on

Introduction to Value Investing

I had the privilege of attending a private seminar featuring a member of Warren Buffett's investment team. At that time, I was working as an advisor at the Learning Annex Adult Education Center in NYC and received an invitation to a talk by a gentleman named Christianson, along with his wife. Both were part of Buffett's advisory team, and although Christianson spoke for the majority of the session, he insisted that his wife was the intellectual force behind their success.

His presentation lasted around three hours, meticulously detailing Buffett's investment tactics. It was a truly captivating experience. This event occurred in 2003, just before I took on a role as a troubleshooter and problem solver for V.I.P. services at the Donald Trump Wealth and Real Estate Expos.

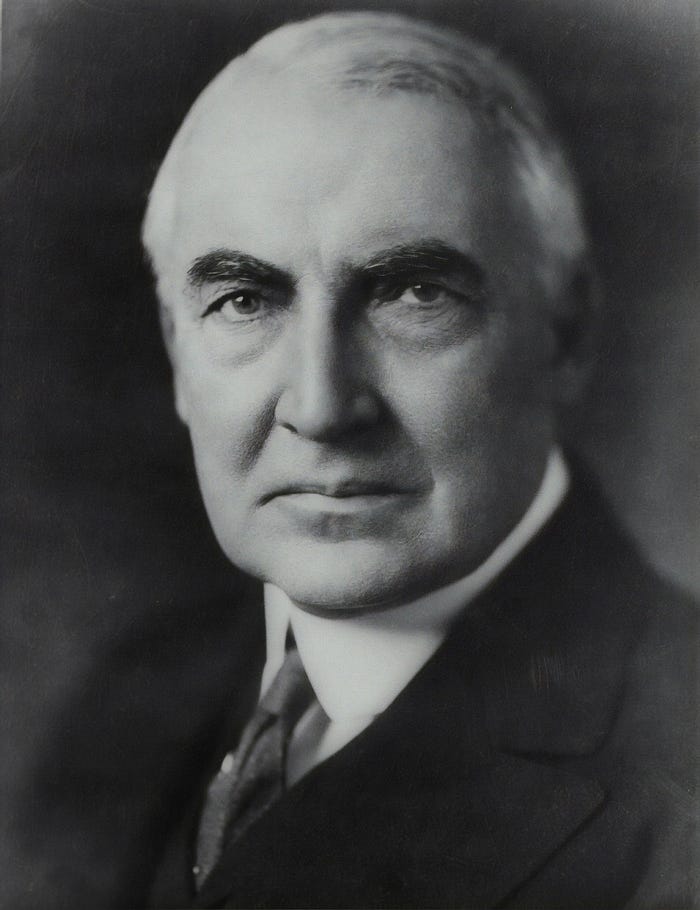

Who is Warren Buffett?

Warren Buffett is an American investor, entrepreneur, and philanthropist, currently serving as the co-founder, chairman, and CEO of Berkshire Hathaway. Renowned for his investment prowess, Buffett ranks among the world’s most recognized investors, boasting a net worth of approximately $139 billion as of April 2024, making him the ninth-wealthiest individual globally.

Buffett hails from Omaha, Nebraska, where his fascination with business and investing began in his teenage years. He graduated from the University of Nebraska at the young age of 19 and later completed his education at Columbia Business School. It was during his time there that he developed his investment philosophy rooted in value investing, a concept originally introduced by Benjamin Graham.

Understanding Value Investing

Tharendra Lunia, a Chartered Accountant and CFA(US) Level III Candidate, provides a clear definition of value investing, referencing Wikipedia: it is an investment strategy derived from the theories of Ben Graham and David Dodd. They began teaching at Columbia Business School in 1928 and later articulated their ideas in their seminal 1934 book, Security Analysis.

While the foundational principles of value investing have evolved, the core idea remains the same: purchasing financial securities that are perceived to be undervalued through systematic and often quantitative analysis. Typically, these include stocks and public companies that:

- Trade at a discount to their book value or tangible book value,

- Offer high dividend yields,

- Feature low price-to-earnings ratios, or

- Have low price-to-book ratios.

Doug Armey, a successful investor and financial consultant, highlights Buffett’s approach in various interviews. During the 2009 market crash, Buffett faced questions about the billions he had seemingly lost.

When asked how it felt to incur such losses, he replied, "I haven't lost anything." He clarified, "The stock price may be down, but I haven't sold, so I haven't lost."

Despite the recession, Buffett made a bold move by purchasing a bankrupt railroad, facing skepticism and claims that he was losing his touch. When questioned about his reasoning for acquiring a railroad during a downturn when shipping was low, he said, "Because I can buy it cheap. We won't always be in a recession, and then there will be plenty of shipping again, making the railroad valuable."

At its essence, true investing is synonymous with value investing. It involves recognizing the disparity between an investment's price and its true value. Savvy investors buy when prices are below intrinsic values, patiently awaiting a price correction, while less discerning investors chase prices, often falling victim to the "Greater Fool Strategy." Though this strategy may yield short-term gains, it is inherently risky, as the market can shift unexpectedly.

As for Buffett's railroad investment? Today, it is worth several times what he initially paid, and he continues to accumulate wealth, defying his critics.

Summary of Buffett's Investment Philosophy

Buffett's success in wealth accumulation stems from a focus on value rather than mere price speculation. He concentrates on identifying stocks trading below their intrinsic or book value. Value investors believe that the market sometimes misprices certain stocks, and they strive to uncover these undervalued opportunities. This often involves seeking out stocks with low price-to-earnings ratios, low price-to-book ratios, and generous dividend yields, a strategy that both Graham and Buffett have effectively employed.

A simple analogy from finance student Rohan Agarwal illustrates value investing: Imagine a cow at a fair priced at $100. You determine its true value based on future milk production to be $200. Despite rumors of a terminal illness leading to a $10 price tag, you buy the cow for just $5. After recovery, its milk production returns to normal, and at the next fair, people are willing to pay $500. Understanding that this new price exceeds its true value, you sell and look for the next undervalued opportunity. This encapsulates the essence of value investing.

The Key Takeaway

Value investing emphasizes the long-term strategy. Warren Buffett has built a fortune worth billions through Berkshire Hathaway. Not only has he established one of the largest companies worldwide, but he is also among the wealthiest individuals on the planet.

Chapter 1: The Back Story of Value Investing

In this chapter, we explore the foundational principles behind value investing and how they have shaped Buffett's strategies.

Chapter 2: Insights from Seth Klarman

Here, we dive into insights from Seth Klarman regarding value investing and how it relates to the teachings of Warren Buffett and Ben Graham.

Conclusion

This content serves as a reminder of the enduring principles of value investing, as championed by Warren Buffett, and encourages readers to adopt a long-term perspective in their investment endeavors.

© 2024 by Lewis Harrison