Mastering Divergence Trading with the MACD Strategy Explained

Written on

Chapter 1: Introduction to MACD Trading

In a prior article, we explored the Moving Average Crossover Strategy, which introduced various techniques utilized in Quantitative Analysis. This post delves into a more intricate method known as the Moving Average Convergence Divergence (MACD) strategy, implemented in Python.

Photo by Nick Chong on Unsplash

Getting Started

Installing Required Libraries

Before we start, ensure you have the necessary libraries installed. We'll be utilizing pandas for data manipulation, yfinance for retrieving historical stock data, and matplotlib for data visualization:

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import numpy as np

Fetching Historical Stock Data

Define a function to acquire historical stock data using the yfinance library:

def get_stock_data(symbol, start_date, end_date):

stock_data = yf.download(symbol, start=start_date, end=end_date)

return stock_data

Chapter 2: Understanding the MACD Strategy

This strategy generates buy and sell signals based on the convergence and divergence of two Exponential Moving Averages (EMAs). The essential components of this approach include:

- Short-term EMA (Fast Line): Typically a 12-period EMA.

- Long-term EMA (Slow Line): Generally a 26-period EMA.

- Signal Line: A 9-period EMA of the MACD line, calculated as the difference between the short-term and long-term EMAs.

Calculating the MACD Line:

- MACD = 12-Period EMA — 26-Period EMA

Calculating the Signal Line:

- Signal = 9-period EMA of MACD

Generating Buy and Sell Signals:

- Buy Signal: Occurs when the MACD line crosses above the Signal line, indicating a potential bullish market.

- Sell Signal: Happens when the MACD line crosses below the Signal line, suggesting a bearish market.

Divergence Confirmation:

Traders often look for divergence between the MACD and the price chart, which may indicate potential trend reversals.

def moving_average_convergence_divergence(data):

print(type(data), dir(data), 'n') # Debugging purposes

short_ema = data['Close'].ewm(span=12, adjust=False).mean()

long_ema = data['Close'].ewm(span=26, adjust=False).mean()

macd = short_ema - long_ema

signal = macd.ewm(span=9, adjust=False).mean()

return macd, signal

Setting Up the Data

Using the previously created get_stock_data function, we will apply it to our strategy. For this example, we will focus on Apple Inc. (AAPL) from 2020 to 2021. Feel free to adjust the dates as needed:

symbol = 'AAPL'

start_date = '2020-01-01'

end_date = '2021-01-01'

data = get_stock_data(symbol, start_date, end_date)

data['MACD'], data['Signal'] = moving_average_convergence_divergence(data)

# Generate Buy/Sell signals

data['Buy_Signal'] = (data['MACD'] > data['Signal']) & (data['MACD'].shift(1) <= data['Signal'].shift(1))

data['Sell_Signal'] = (data['MACD'] < data['Signal']) & (data['MACD'].shift(1) >= data['Signal'].shift(1))

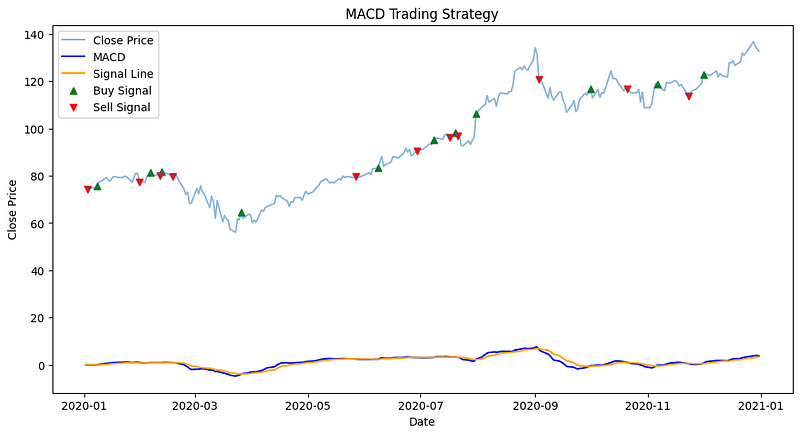

Visualizing the Strategy

Now, let's visualize the strategy, including both the buy and sell signals.

plt.figure(figsize=(12, 6))

plt.plot(data['Close'], label='Close Price', alpha=0.5)

plt.plot(data['MACD'], label='MACD', color='blue')

plt.plot(data['Signal'], label='Signal Line', color='orange')

# Highlight Buy signals

plt.scatter(data.index[data['Buy_Signal']], data['Close'][data['Buy_Signal']], label='Buy Signal', marker='^', color='green')

# Highlight Sell signals

plt.scatter(data.index[data['Sell_Signal']], data['Close'][data['Sell_Signal']], label='Sell Signal', marker='v', color='red')

plt.title('MACD Trading Strategy')

plt.xlabel('Date')

plt.ylabel('Close Price')

plt.legend()

plt.show()

The signals appear as the MACD (in dark blue) intersects with the Signal line (in orange).

Chapter 3: Conclusion

In this article, we introduced the Moving Average Convergence Divergence Strategy. Similar to the Moving Average Crossover Strategy, this method is not intended for live trading without thorough backtesting, validation, and refinement. In the next post, we will explore the Bollinger Bands and RSI strategy. Please share your thoughts; I’d love to hear your feedback!

Video Description: Improve Your Trading with the MACD indicator, explaining how to utilize this powerful tool effectively.

Video Description: A must-watch on the MACD Divergence Trading Strategy, offering insights and practical applications.