Understanding the Unique Nature of the Current Tech Bubble

Written on

Chapter 1: A Market in Turmoil

The stock market is currently facing severe challenges, with many once-popular stocks like Zoom, Peloton, and Carvana suffering significant declines. Major tech giants, including the FAANG group and Microsoft, have seen their combined market value shrink by nearly $1.4 trillion during the turmoil experienced in April. While we find ourselves in a "tech bubble," this particular situation stands apart from previous instances.

Going Back to 2001

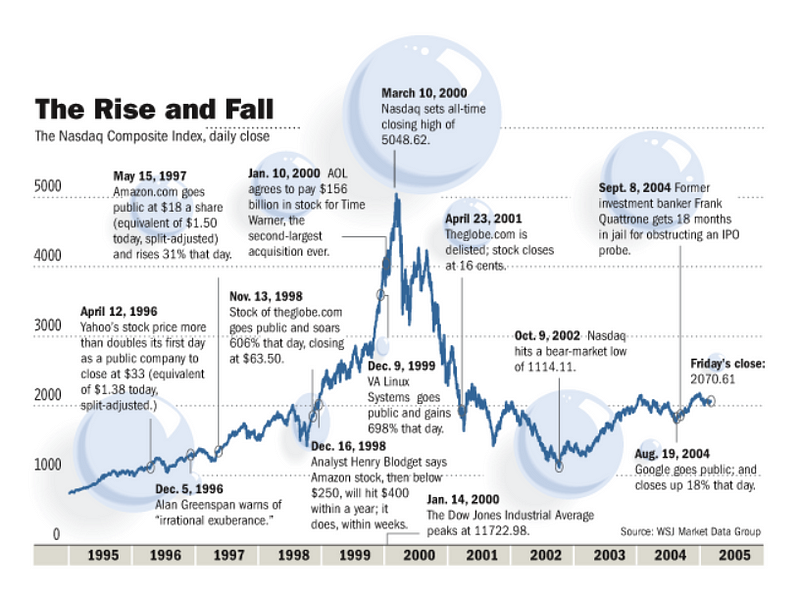

Reflecting on the tech bubble of 2000 and 2001, it's clear that the circumstances were notably different from today. The early 2000s bubble was largely driven by rampant speculation surrounding technology stocks, coinciding with the advent of the internet. Visionaries recognized the internet's transformative potential, akin to the current perception of Bitcoin. Both private and public investors funneled massive amounts of capital into internet startups, often encouraged by investment banks incentivizing analysts to promote unviable dot-com ventures. At the peak in 2000, NASDAQ IPOs amassed a staggering $54 billion—an unprecedented milestone. Between 1995 and 2001, 439 dot-com companies entered the public market, with an average of $160 million invested daily in private tech firms during the final quarter of 1999. However, this speculative frenzy came to a halt when NASDAQ peaked at 5048.62 points on March 10, 2002, only to plummet to its nadir on October 9, 2002, leading to the collapse of numerous tech companies. Yet, from this crash emerged some of the world's most valuable enterprises such as Amazon, Alphabet (Google), and Meta (formerly Facebook).

Source: Global Entrepreneurship Institute

A Return to 2022

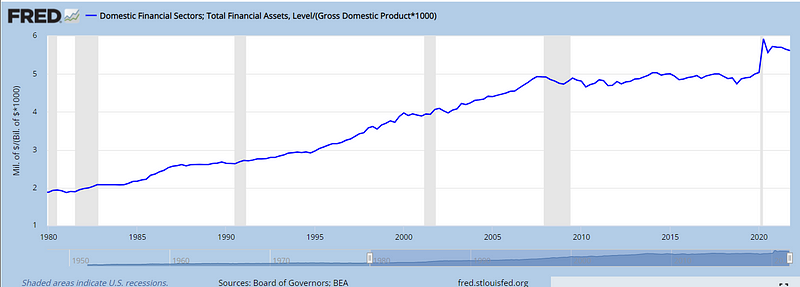

In stark contrast to the investor-driven frenzy of the early 2000s, the stock market boom from the 2010s into the early 2020s has been primarily fueled by monetary policy. The introduction of zero percent interest rates, coupled with aggressive money printing, has significantly inflated asset values. The following charts depict the growth of financial asset values relative to US GDP (source: St. Louis Fed FRED).

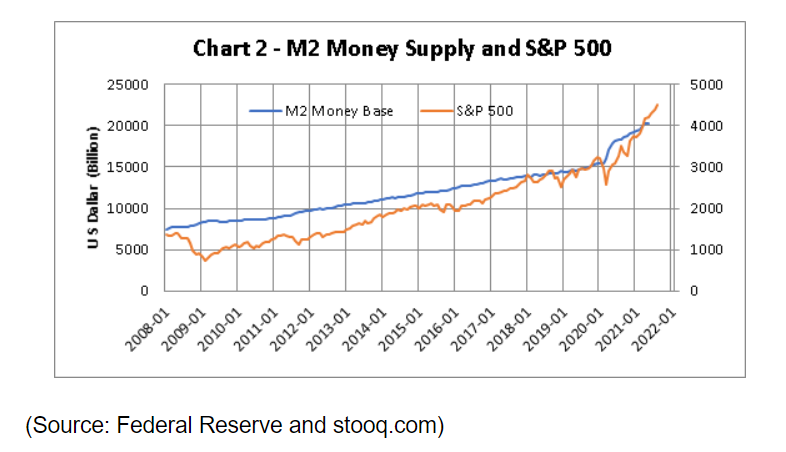

Additionally, the correlation between Federal Reserve M2 money supply and stock market growth is evident (source: Man Yin To | Seeking Alpha Contributor).

The environment of easy money and historically low interest rates has inflated asset prices, leading investors to seek higher returns. This has resulted in increased capital flowing into various sectors, including commercial real estate, tech startups, and the stock market. The rise of passive investment strategies, such as ETFs, has further channeled funds from individual investors into established US stocks.

The Federal Reserve faces a daunting dilemma. Years of low interest rates and substantial money supply increases have created an unprecedented asset bubble, while inflation rates are surging. If the Fed proceeds with its planned rate hikes, a recession and substantial market downturns may follow. Unlike previous crises, the US economy is now heavily financialized, putting many retirement accounts at risk of significant losses. As Wall Street braces for potential turmoil, it’s clear that the Fed is navigating a precarious path, particularly in light of the approaching Midterm elections and declining approval ratings for President Biden. On a recent podcast, Morgan Creek's Mark Yusko expressed skepticism about the Fed's ability to manage more than three rate hikes, a sentiment I share. The Fed aims to combat inflation without destabilizing the market.

The 2010s will likely be characterized by monetary expansion and the rise of Web 2.0, yet we are beginning to observe cracks in this narrative. Tech stocks, including the FAANG group, are experiencing significant downturns. Notably, Chase Coleman of Tiger Global has reported a staggering 44% loss year-to-date, while Cathie Wood’s Ark Invest ETF has declined nearly 40%. The worst may still lie ahead, with food inflation reaching record levels and global shifts away from the US Dollar gaining momentum. As the Fed continues to raise rates to combat inflation, the repercussions for financial markets could be severe. While I cannot predict the future, it is evident that uncertainty and risk are likely to escalate.

Nevertheless, with hardship comes opportunity. This is an opportune moment for strategic investments (discussed in previous sections). Historically, some of the most significant companies, including Amazon, Apple, and Microsoft, emerged from the aftermath of the tech bubble. Similarly, we are witnessing the emergence of new technologies and asset classes like Bitcoin and cryptocurrencies, which are poised to redefine finance and decentralized applications. As investors seek avenues for their capital, we can anticipate an influx of funds into crypto, as well as commodities and climate change technologies. Companies that have thrived on easy money may collapse, while robust emerging tech firms could become the next industry leaders. As the current "everything bubble" bursts, we should expect valuable opportunities to arise from the ruins.

Please note, this is not investment advice but rather an educational piece. Consult a financial advisor before making investment decisions and conduct thorough research. Investing carries inherent risks.

If you enjoyed this article, feel free to follow my work on Medium. Your comments and support are appreciated. You can also explore more exceptional writing through my referral link. Additionally, I'm now active on Substack, offering in-depth analyses. Rest assured, I will continue my work on both platforms.

Lastly, check out my sister's educational children's book about the heart, a great resource for young learners and a perfect gift for birthdays.

As always, take care, stay healthy, and thrive!

The first video explores the current state of the tech market amidst speculation, titled "Is The Tech Bubble Crashing? NO But......".

The second video compares the current tech bubble with past events, titled "Double Trouble: How the Dot-Com and Tech Bubbles Compare".